Hefei Super Electronics Co., Ltd.

Hefei Super Electronics Co., Ltd.

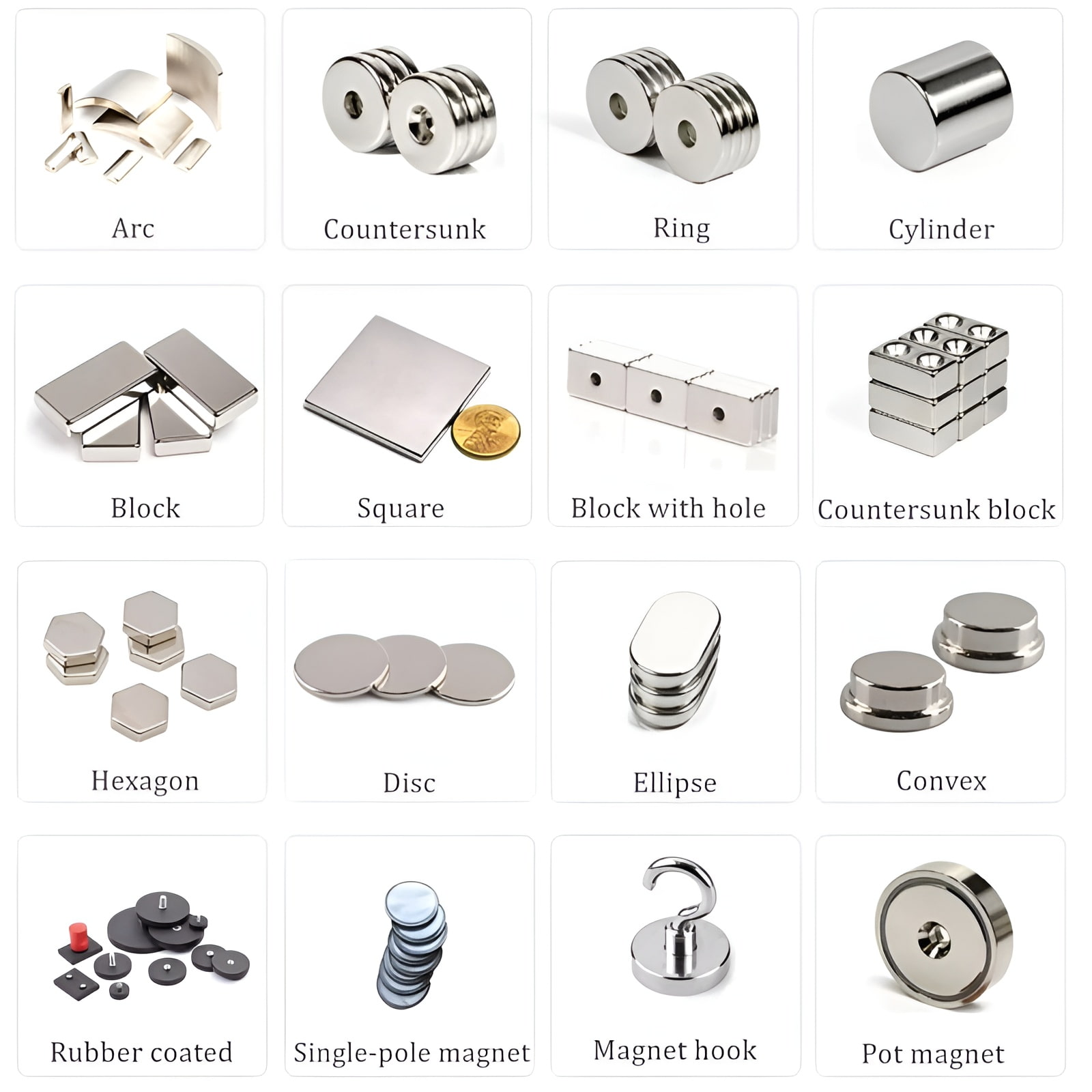

What Are You Looking For?

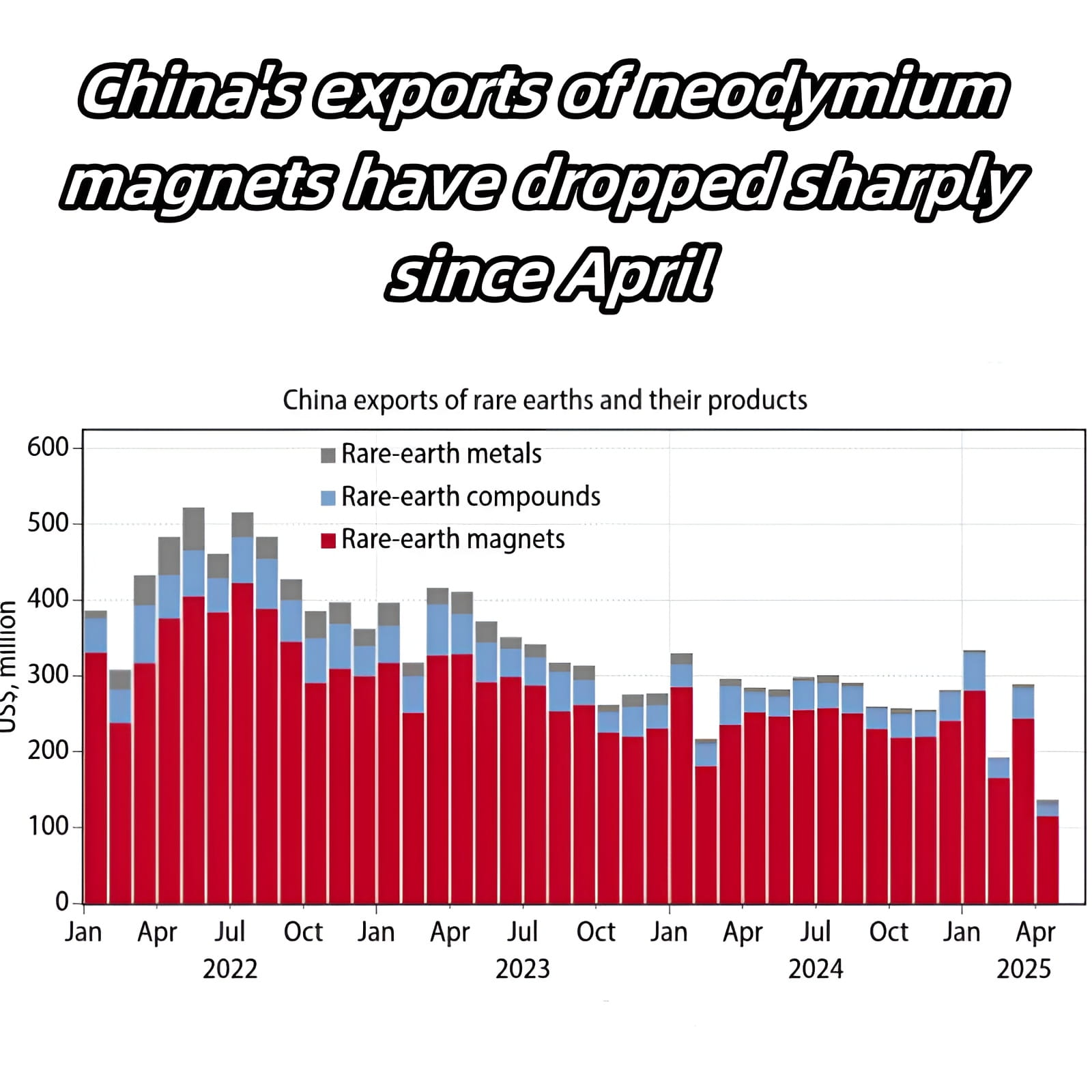

The global neodymium magnet materials market is entering a period of high volatility, with price trends expected to be influenced by a variety of factors over the next 6-12 months. From rising rare earth costs to ongoing logistical challenges and a growing supply-demand imbalance, companies relying on neodymium magnets and related materials should prepare for market volatility and potential cost increases.

1. Rare Earth Price Pressure

Rare earth elements, particularly neodymium, praseodymium, and dysprosium, are key raw materials for high-performance magnets. In recent months, Chinese suppliers, which account for the majority of global production, have implemented stricter supply quotas and an auction-based distribution system. This has already led to price increases, which are expected to rise further as renewable energy, electric vehicles, and high-tech manufacturing continue to expand. Analysts predict that continued demand growth, combined with controlled supply, could keep prices elevated until mid-2026.

2. Logistical Disruptions and Costs

The global shipping industry remains under pressure due to port congestion, geopolitical tensions, and reduced shipping capacity for certain cargo categories, including rare earth products. Freight rates are volatile, and carriers are increasingly prioritizing high-value or time-sensitive cargo. For magnet buyers, this means longer delivery times and higher shipping costs, especially for small shipments shipped by air or courier.

3. Supply and Demand Imbalance

While demand for top quality permanent magnets is booming, driven by electric vehicle motors, wind turbines, robotics, and consumer electronics, production capacity has not grown in tandem. Even with new mining projects in Australia, the United States, and Africa, magnet refining and manufacturing remain concentrated in Asia, creating bottlenecks and increasing price sensitivity to any disruptions.

4. Outlook and Recommendations

Market analysts predict that ndfeb magnet material prices will continue to rise over the next 6-12 months, potentially peaking in late 2025 if supply constraints persist. Companies should consider forward purchasing to lock in favorable prices, building a diversified supplier network to reduce reliance on a single region, and exploring recycling or material efficiency measures to reduce costs.

In short, the magnet material market will continue to be in short supply. In an increasingly competitive environment, proactive supply chain management, strategic sourcing, and product design optimization are crucial for both our dedicated ndfeb magnet product manufacturers and our import buyers seeking to maintain cost stability and secure material supply.