How to Clearly Communicate NdFeB Magnet Requirements?

Clear and accurate communication is fundamental to all successful NdFeB magnet projects. In industrial applications, even minor misunderstandings of specifications can lead to performance issues, production delays, or unnecessary cost increases. From a professional ndfeb magnet manufacturing perspective, accurately defining technical requirements early in the project ensures efficiency, consistent quality, and predictable results.

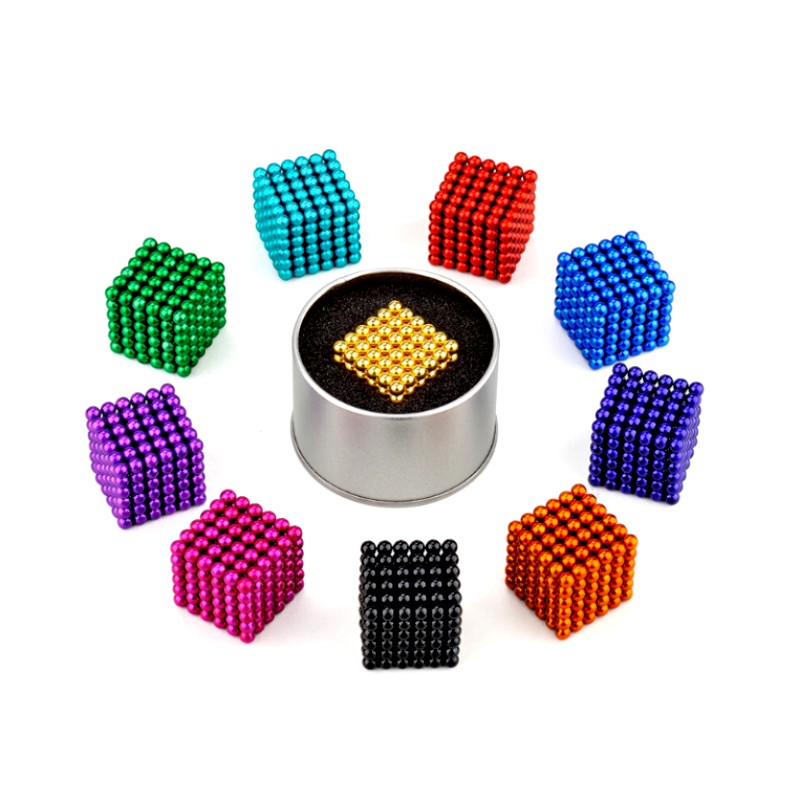

The most important and critical element is the magnet grade. NdFeB magnets come in various grades, such as N35, N42, N52, and high-temperature series like N42SH or N35UH. Each grade reflects its inherent characteristics, including remanence, coercivity, and maximum operating temperature. Simply requiring a "strong magnet" is insufficient. The required magnetic strength, operating ambient temperature, and safety margins should all be clearly specified.

Dimensions and tolerances are equally important. Length, width, thickness, outer diameter, inner diameter (for toroidal magnets), and chamfers must be clearly defined in millimeters or inches. Tolerances are equally crucial. Excessively small tolerances increase machining time and cost, while excessively large tolerances negatively impact assembly performance. Setting functional tolerances based on actual assembly requirements helps strike a balance between accuracy and budget.

Magnetization direction is another often overlooked critical parameter. Axially magnetized NdFeB magnets are the most common choice for general applications. Radial and multi-pole magnetization can also be customized when specific magnetic field orientations are required. The correct magnetization direction directly determines how the magnet interacts with adjacent components. Providing drawings or application diagrams can prevent costly errors.

The choice of surface coating should also be based on the working environment. Common coatings include nickel-copper-nickel coatings, epoxy coatings, zinc coatings, and special corrosion-resistant coatings. For humid, outdoor, or marine environments, enhanced corrosion resistance may be required. Mechanical requirements, such as adhesive or press-fit mounting, will further influence coating selection.

The working environment conditions must be clearly described. Maximum operating temperature, vibration, humidity, mechanical stress, and ambient magnetic fields all affect the long-term performance of NdFeB magnets. NdFeB magnets are strong but brittle; mechanical shock can cause them to crack. If the magnet will be embedded in magnetic components or used in conjunction with a steel housing, relevant information should be provided.

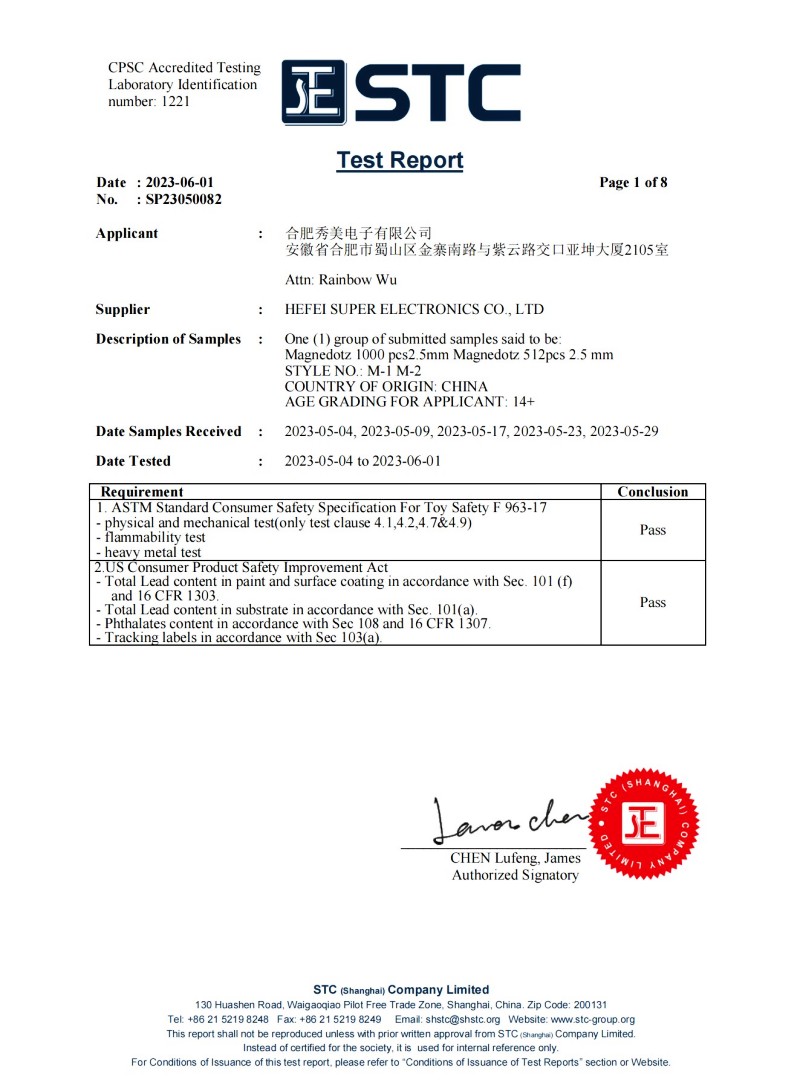

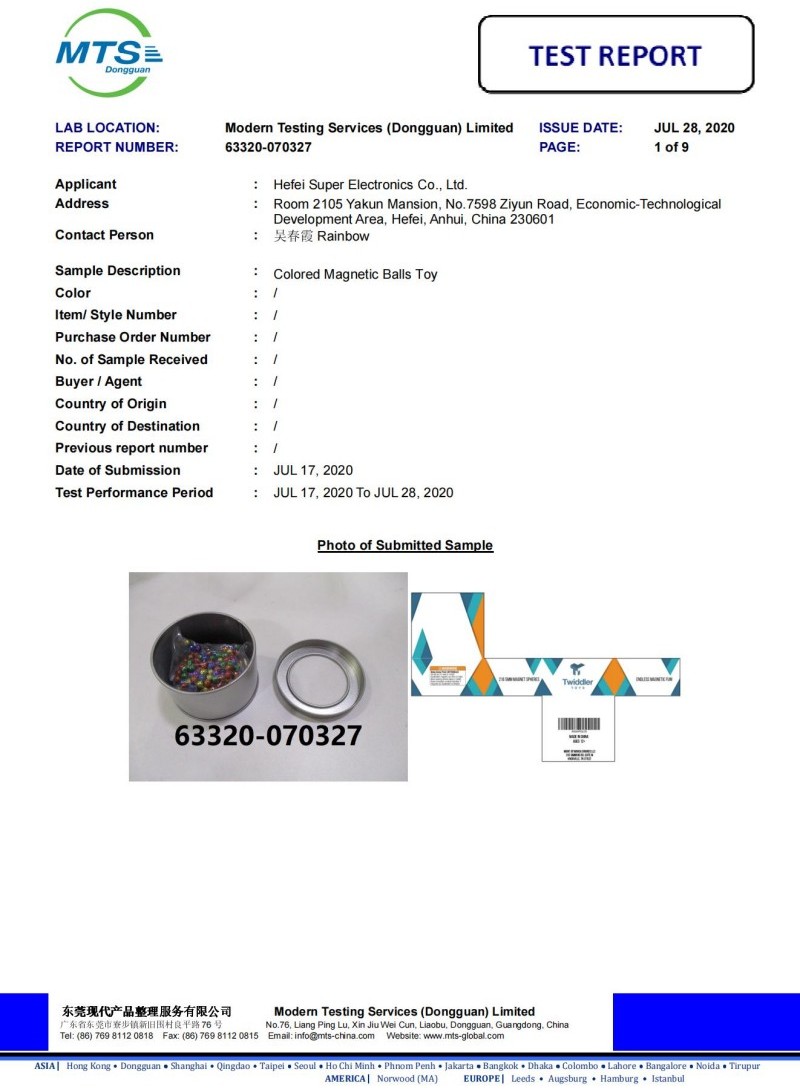

Testing and verification standards are another crucial aspect of communication. Clearly defined tensile strength requirements, magnetic flux density targets, testing methods, and sampling criteria help ensure consistency throughout the production and quality control process. Finally, providing detailed technical drawings, 3D files, or application specifications can significantly improve efficiency. Clear documentation reduces iterative communication and shortens development cycles.

Effective communication of customized NdFeB magnet requirements is not about arbitrarily listing parameters, but about defining performance targets, environmental conditions, dimensional accuracy, and verification standards in a structured manner. If all requirements are fully understood early in the project, the production process will be smoother, costs will be effectively controlled, and magnet performance will consistently meet expectations.

0+

0+ 0+

0+ 0

0

en

en de

de Hefei Super Electronics Co., Ltd.

Hefei Super Electronics Co., Ltd.

IPv6 network supported

IPv6 network supported