Hefei Super Electronics Co., Ltd.

Hefei Super Electronics Co., Ltd.

What Are You Looking For?

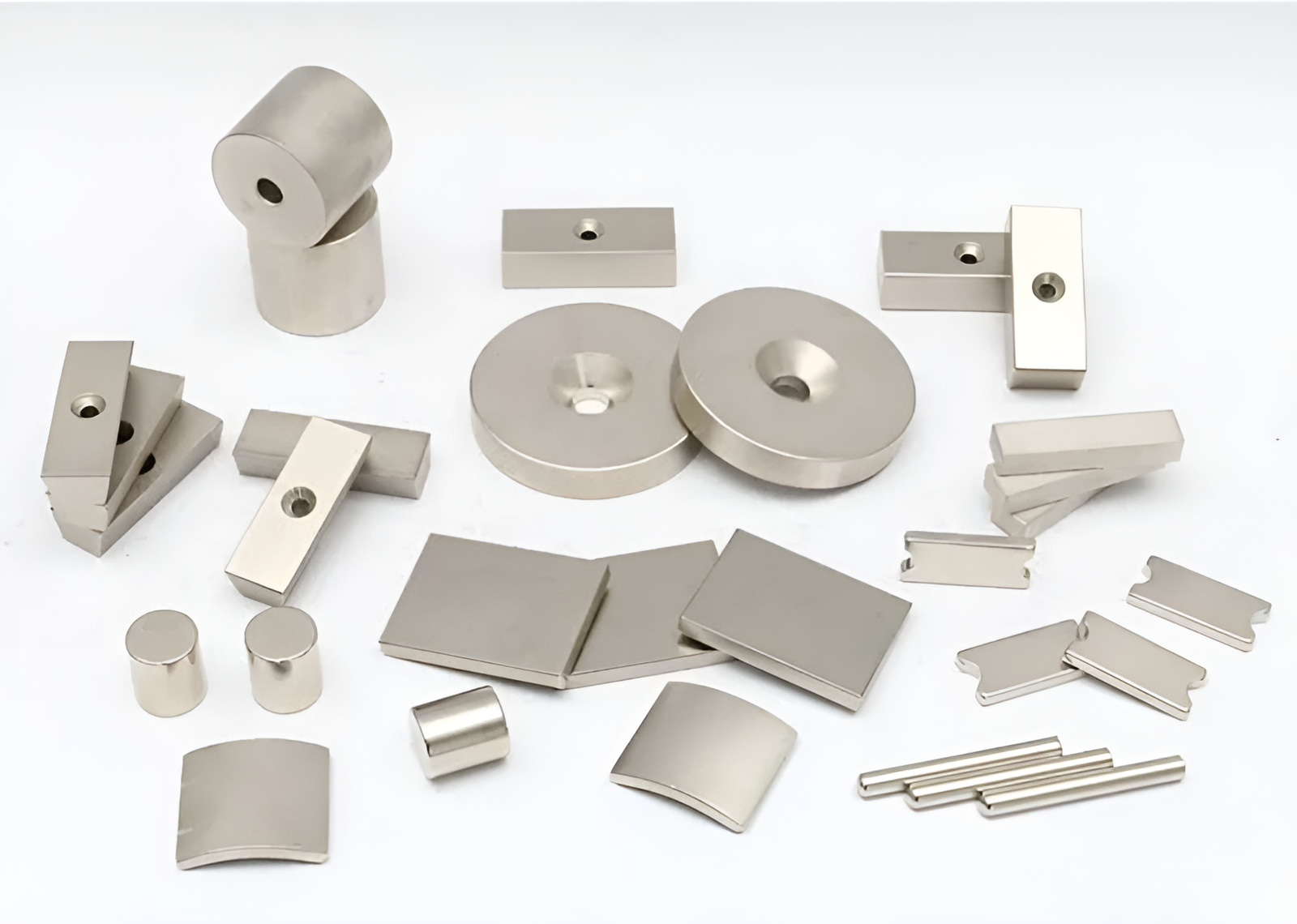

Starting April 1, 2025, the United States has eliminated the de minimis threshold, which previously exempted imported goods valued under $800 from tariffs. This change has significantly impacted Chinese NdFeB (neodymium permanent magnet) exporters and U.S. buyers alike. Faced with rising costs, how can U.S. NdFeB buyers reduce their procurement expenses? Here are some strategies:

1. Partner with Reliable Suppliers to Stabilize Costs

In times of policy uncertainty, working closely with trusted suppliers can help mitigate risks. Established suppliers often have the experience and resources to navigate regulatory changes and provide stable pricing. By building long-term partnerships, buyers can secure better terms and ensure a steady supply of high quality NdFeB magnets.

2. Optimize Order Quantities and Shipping Methods

Buyers can reduce costs by optimizing their order quantities and selecting the most cost-effective shipping methods. For example:

Consolidate Orders: Increasing order volumes can help spread out fixed costs, such as tariffs and logistics expenses, reducing the per-unit cost.

Choose Efficient Shipping Options: Depending on urgency, buyers can opt for sea freight or rail transport, which are often more economical than air freight.

3. Leverage Free Trade Zones to Delay Tariff Payments

Utilizing free trade zones (FTZs) can be a strategic way to manage cash flow. By storing and processing goods in FTZs, buyers can delay paying tariffs until the products are ready to enter the U.S. market. This approach provides flexibility and helps ease the immediate financial burden.

4. Stay Informed and Adapt to Policy Changes

The new U.S. tax policy is still evolving, and its long-term implications remain uncertain. Buyers should stay updated on policy developments and work closely with their suppliers to adapt quickly. Proactive communication with suppliers can help identify potential challenges and opportunities early on.

5. Collaborate with Suppliers for Customized Solutions

Many golden neodymium magnets suppliers, especially those with extensive experience in international trade, can offer tailored solutions to help buyers navigate the new tax landscape. For example, suppliers may provide value-added services such as pre-shipment inspections, customized packaging, or assistance with documentation to streamline the import process and reduce costs.

Turning Challenges into Opportunities

While the new U.S. tax policy presents challenges, it also encourages buyers and suppliers to work more closely together to find innovative solutions. By partnering with reliable suppliers, optimizing logistics, and staying informed, NdFeB buyers can effectively manage costs and maintain a competitive edge in the market.

Hi! Click one of our members below to chat on